Why you may want to buy a house vs. renting ? For both financial and personal reasons, you may discover that owning your own house outweighs the expenses. Here are five reasons why buying your own home might make sense:

- Build equity. As you make payments on your loan, and/or if the value of your home goes up, you achieve equity. The greater the difference between what you owe on your mortgage and what your house is worth, the more equity you have. You can borrow against this equity or even refinance your mortgage and get some cash out. This financial cushion is appealing to many people and may be a lower risk compared to many types of investments.

- Potentially reduce your tax burden. When you have a mortgage, you may be able to deduct the interest you pay from your income taxes. (Investment properties 100% interest Tax right off) This often means you may also deduct points and some closing costs related to prepayment of interest. And you may be able to deduct some of your property taxes and take exemptions for using part of your home as a workplace. Consult your tax advisor about your personal situation.

- Location. Apartments may not be available in all areas you are interested in. When you buy property, you can choose from more varied locations, including rural homes with more land.

- Do what you like. When you rent, you’re often limited in what improvements you can make. You usually can’t choose your appliances or wall color. When you buy, you have more freedom to rework your space to meet your tastes and needs. Additionally, you may not have to worry about paying for minor damages that occurred if you don’t want to fix them.

- Privacy. You typically have more privacy when you own a home than when you rent.

- SALT Deduction . As of now Federal govt giving upto $10k tax refunds which you miss when you rent

- HOMESTEAD REBATE: New Jersey you get this if you quality (but you must own it for some time).

- USE IT or RENT IT. When you own, you can rent it or lease if you can’t use it v/s you keep reward of earning equity and divined (if rent is more then mortgage).

- Cant be forced out. IF you cant afford rent for any reason, then you get time to negotiate with bank . This time can help you get back to normal. If renting and you loose then you can be forced to leave.

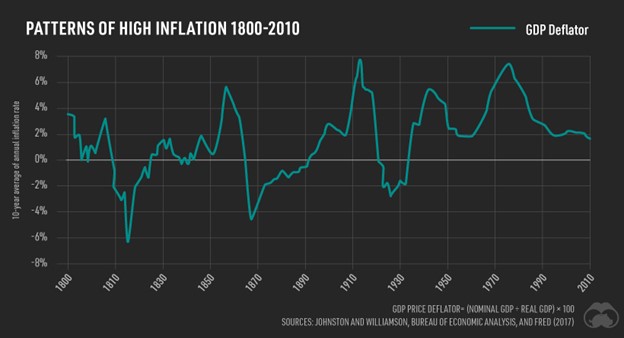

- MOST IMPORTANT. You claim deprecation while claiming appreciation. so in nutshell you claim as if property loosing value but you and we know that properties’ historically increase in value (not call cars unless they becoame vintage)

Costs in buying a house

- Down payment. You’ll have to save some money to put down on a house purchase. This can be as little as 3% of the total purchase price, but if you put at least 20% down on most mortgages, you won’t have to pay for mortgage insurance.

- Mortgage payment. Each month, you’ll make a payment toward your mortgage balance. If you have a fixed-rate mortgage, your payment will stay relatively stable for the life of the loan which can help you make a long-term budget plan.

- Closing costs. When you buy a home, you’ll have several expenses related to getting a mortgage and taking ownership. This may include an appraisal of the property as well as loan origination and title fees, legal fees and more. These closing costs are usually about 3 to 5% of the total purchase price.

- Maintenance and repairs. As a homeowner, you’ll be responsible for all the costs of repairs should something go wrong. You’ll also have regular maintenance costs, such as for weatherizing, painting, landscaping, etc.

- Utilities. Many apartments roll the costs of some or all utilities into your rent, but homeowners must separately pay for water, sewer, electric, gas, garbage and recycling and in some cases, Homeowner Association Fees.

- Property taxes. Every year, you’ll be responsible for paying taxes that support services for the community you live in. The amount is based on the assessed value of your home.

- Insurance. You need to have insurance that covers your home and belongings against loss and damage from things like weather, fire and theft.

Costs in renting an apartment

- Monthly rent. Rent can increase, sometimes on an annual basis. You may pay more if you have specific amenities, like access to an on-site gym, or if you live with a pet.

- Security deposit. Many rentals require the equivalent of one or more months’ rent to cover any damages.

- Insurance. You’re usually not required to have renter’s insurance, but a policy will cover your belongings if the apartment is damaged.

- Utilities. These may or may not be covered in your rent, but you could have to pay for at least your cable and internet should you wish to have these.

While the upfront costs of buying a home may be higher, the monthly payments may be similar, and you get additional benefits of building equity and having the freedom to make improvements to your property.

How to get started moving from an apartment to buying a home

If you’ve decided that homeownership is right for you, you can start by saving for a down payment. Your goal should be 20% of the purchase price, though it may make financial sense for you to buy before you have that amount.