-

Table of Contents

What is Flip Purchase and How Does it Work?

Flip purchase, also known as flipping, is a popular investment strategy in the real estate market. It involves buying a property with the intention of quickly reselling it for a profit. This practice has gained significant traction in recent years, with many individuals and companies successfully utilizing it to generate substantial returns on their investments. In this article, we will explore the concept of flip purchase in detail, examining how it works and why it can be a lucrative venture.

The Process of Flip Purchase

The flip purchase process typically involves the following steps:

- Identifying Potential Properties: Flippers search for properties that have the potential to be renovated and sold at a higher price. They often look for distressed properties, such as foreclosures or homes in need of significant repairs.

- Conducting Market Research: Before making a purchase, flippers thoroughly research the local real estate market to determine the demand for renovated properties and the potential selling price.

- Calculating Costs: Flippers carefully calculate the costs involved in purchasing and renovating the property. This includes the purchase price, renovation expenses, holding costs (such as property taxes and insurance), and any additional fees.

- Securing Financing: Flippers often rely on financing options, such as loans or partnerships, to fund their purchase and renovation costs.

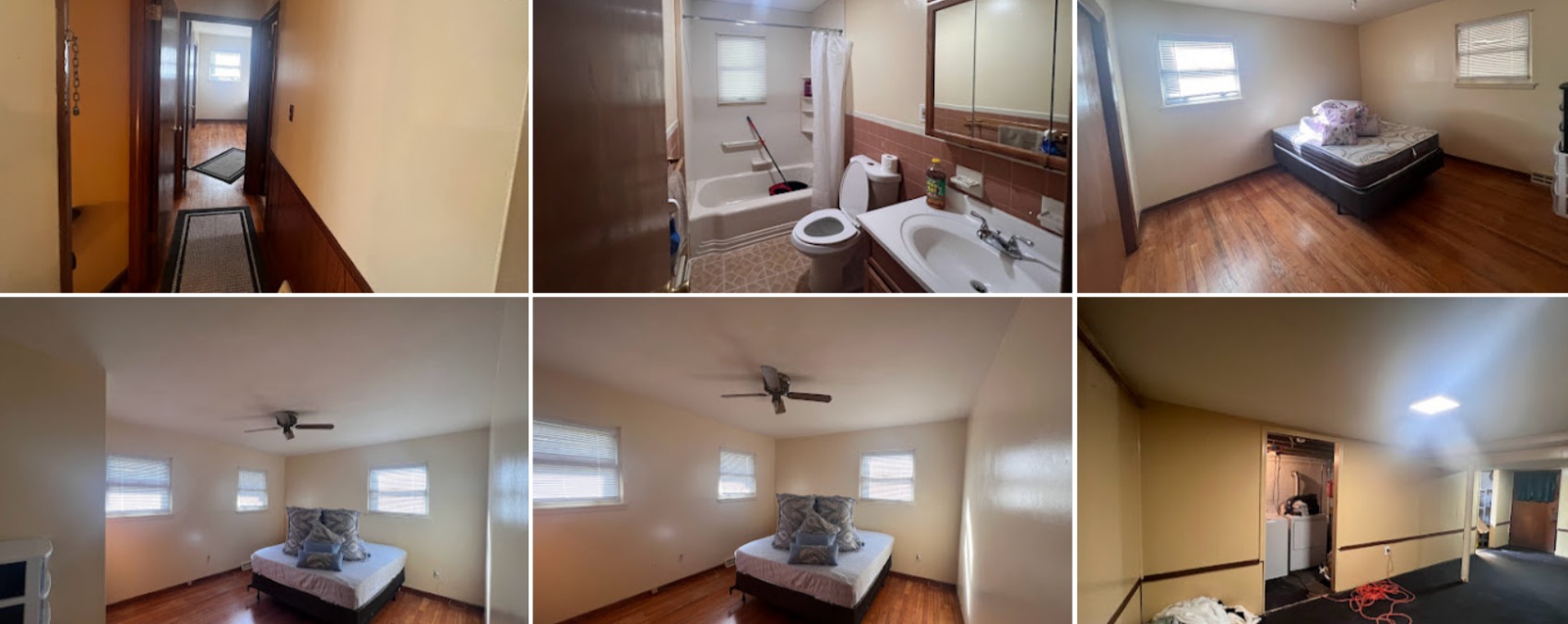

- Renovating the Property: Once the property is acquired, flippers proceed with the necessary renovations and improvements to increase its value. This may involve updating the kitchen, bathrooms, flooring, or other aspects of the property.

- Marketing and Selling: After the renovations are complete, flippers market the property to potential buyers. They aim to sell the property quickly to maximize their profits.

- Closing the Sale: Once a buyer is found, the flipper finalizes the sale and receives the proceeds from the transaction.

Factors Contributing to Flip Purchase Success

Several factors contribute to the success of flip purchase ventures:

- Location: Properties located in desirable neighborhoods or areas experiencing growth tend to attract more buyers and command higher prices.

- Renovation Quality: Flippers who invest in high-quality renovations and upgrades can significantly increase the value of the property, making it more appealing to potential buyers.

- Market Conditions: A strong real estate market with high demand and low inventory can create favorable conditions for flippers, allowing them to sell properties quickly and at higher prices.

- Timing: Flippers need to carefully time their purchases and sales to take advantage of market fluctuations and maximize their profits.

Case Study: Successful Flip Purchase

To illustrate the potential of flip purchase, let’s consider a case study:

John, an experienced flipper, identified a distressed property in a rapidly developing neighborhood. After conducting thorough market research, he estimated that the property could be renovated and sold for a 30% profit. John secured financing from a private investor and purchased the property for $200,000.

Over the next three months, John invested $50,000 in renovations, including updating the kitchen, bathrooms, and landscaping. Once the renovations were complete, he listed the property for sale at $325,000, taking advantage of the high demand in the area.

Within two weeks, John received multiple offers and ultimately sold the property for $320,000. After deducting the renovation costs and other expenses, John made a profit of $50,000, achieving a 25% return on his investment in just a few months.

Conclusion

Flip purchase can be a lucrative investment strategy in the real estate market. By identifying potential properties, conducting thorough market research, and executing high-quality renovations, flippers can generate substantial profits in a relatively short period. However, it is important to note that flip purchase also carries risks, such as unexpected renovation costs or a downturn in the real estate market. Therefore, careful planning, market analysis, and financial management are crucial for success in this venture.