Why Buy Land? The land asset is is considered to have an infinite useful life so it’s not depreciated. Land asset is only one for which depreciation is prohibited.

Nearly all fixed assets have a useful life, after which they no longer contribute to the operations of a company, or they stop generating revenue. During this useful life, they are depreciated, which reduces their cost to what they are supposed to be worth at the end of their useful lives (which is known as salvage value). Land somehow has no definitive useful life, so there is no way to depreciate it. Instead, in the absence of natural resources that are to be extracted, land is considered to have an unlimited life span. Further, due to the scarcity of land, its value tends to increase over time, as opposed to the decline in value of most other types of fixed assets.

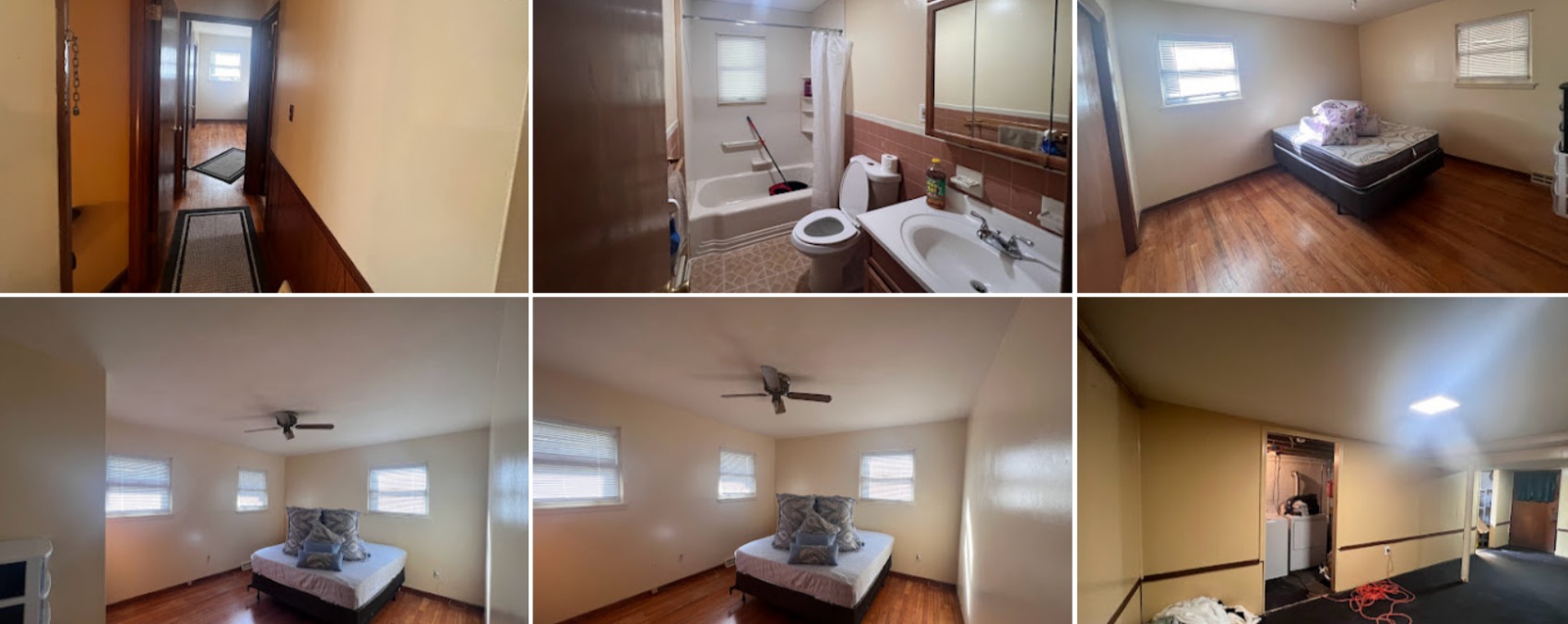

When an entity purchases land that has a building on it, the cost must be allocated between the land and the building; the result will be depreciation of the building, but not the land. A good way to derive this allocation is to use a property tax assessment or appraisal.

The one exception to the rule not to depreciate land is when some aspect of the land is actually used up, such as when a mine is emptied of its ore reserves. In this case, you depreciate the natural resources in the land using the depletion method.

Depletion is the annual charge for the use of natural resources. In order to compute depletion, it is first necessary to establish a depletion base, which is the amount of the depletable asset. The depletion base includes the following elements: