Yes that correct Mortgage Rates Increase By 1% a Buyer Loses 10% in Affordability!

Did you know that with every 1% rise in rates, the buyer loses 10% in affordability. It is now very important that buyers understand that rising interest rates will eat away any savings they could get from waiting for prices to dip again. Eventually a buyer needs to make a decision what is most important, their monthly payment or “finding the bottom of the market in terms of price”.

Cost vs price. What is the difference?

A lot of buyers have a tendency to look at just the PRICE of the house instead of the overall COST to buy the home. The cost is actually more important. So what is the difference between cost vs price and why is this so important for a buyer to understand? Cost is what a buyer will pay for a home overall, including financing costs. Price is just the actual price tag the buyer will pay the seller for the home not including any financing costs.

This is why it is so important for buyers to understand that rising rates have a tremendous impact on a buyer’s overall cost and monthly payment. We all know there are home buyers still standing on the sidelines waiting for the prices of real estate to hit rock bottom. But buyers need to be concerned about the monthly COST as much as they are concerned about the PRICE of the home. Here is why.

Impact of higher rates on payment

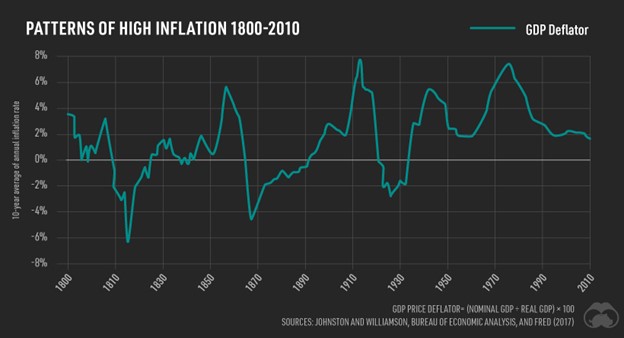

Let’s take a look at some numbers to see what rising interest rates do to the monthly payment on a loan. Here is a great chart below that shows as the rate goes up the affordability of the buyer goes down. As you can see, with every 1% increase in rates, the buyer loses 10% in affordability.

So lets say if someone was shopping in the $400k range a month ago because that was their maximum mortgage budget, unfortunately that same buyer will now need to be looking in the $360k price range today to keep the same monthly mortgage budget.

Making sure buyers still qualify at higher rates

Unfortunately higher interest rates are going to affect a buyer’s purchasing power and monthly mortgage budget. So it is going to be very important that buyers know if they can still qualify and can afford higher rates. For example, a pre approval that the buyer has had for 3-6 months putting in offers at 4% that stretched their budget, might be unaffordable now because rates are at 5%. For example, on a $400k loan the payment increases $238 a month when the rate jumps from 4% to 5%. This is almost a car payment for some families.

Higher rates will also affect any current purchase offers or loan approvals that buyers may have. So for someone that was shopping in the $400k range a month ago and the rate was 4%, that same monthly payment will only get a home for $360k now with rates at 5%. Remember also, lenders have been tightening their qualifying ratios recently and are constantly changing their rules, so make sure any increase in rates/payments do not disqualify a buyer from a certain price range either.

What are rates at now? They are still at 40 year lows!

With rates now historically lowest in history of USA, which is 2.65%, the question is where will they go from here? All experts are predicting they are on their way to up soon, But on a positive note, they are still at historical lows when you compare them with interest rates over the past 40 years.

So for anyone still looking at buying a home, you can let them know they can still qualify for the lowest rates in 40 years. Hopefully this will lessen the blow for those folks that did not get an opportunity to purchase when they were in the low 4% range.

1% interest rate drop could save you whopping $60,276.16 in $300000 loan in 30 years . Check your at our calculator https://njfind.com/financial-calculators

Mortgages and Interest Rates

When you purchase a 15-year fixed-rate or 30 year fixed rate mortgage, the interest rate will stay the same for the entire life of the loan. Your monthly payment is based on the interest rate you negotiate with your lender and is structured to pay off your mortgage by the end of the 15-year period or 30 year period resp. 15 year is typically the shortest fixed-rate period offered by lenders and will allow you to pay off your mortgage faster and pay less interest than with a longer term loan. However, the shorter term means your monthly payment will be higher, so consider whether you can afford it. Also when you take 30 year fixed, you are stretching your dollar which is depreciating in years or what dollar can buy today, will be lot less in 30 years.

So as per calculator,

| loan amount in $ | Interest % | # of years | Monthly Payment: | Number of Payments: | Total Payments: | Total Interest: | saving |

per month saving

|

| 300000 | 4 | 30 | $1,432.25 | 360 | $515,608.52 | $215,608.52 | 0 | 0 |

| 300000 | 3 | 30 | $1,264.81 | 360 | $455,332.36 | $155,332.36 | $60,276.16 | $167.43 |

| 300000 | 4 | 15 | $2,219.06 | 180 | $399,431.48 | $99,431.48 | 0 | 0 |

| 300000 | 3 | 15 | $2,071.74 | 180 | $372,914.09 | $72,914.09 | $26,517.39 | $147.32 |

|

This table made by Anil Aggarwal using Financial Calculator provided free at his website :https://njfind.com/financial-calculators

|

||||||||