Buying foreclosed property at a sheriff’s sale or buying foreclosed property at a sheriff’s sale is one way to get a great deal on an investment property. There are several rules for this type of sale and understanding them can help you make an educated – and perhaps lucrative – purchase.

A sheriff’s sale is a type of public auction where interested buyers can bid on foreclosed properties. In a sheriff’s sale, the initial owner of a property is unable to make their mortgage payments and legal possession of the property is regained by the lender. The lender will then attempt to sell it to recover some, if not all, of the outstanding mortgage balance.

What Types of Properties Are Auctioned Off?

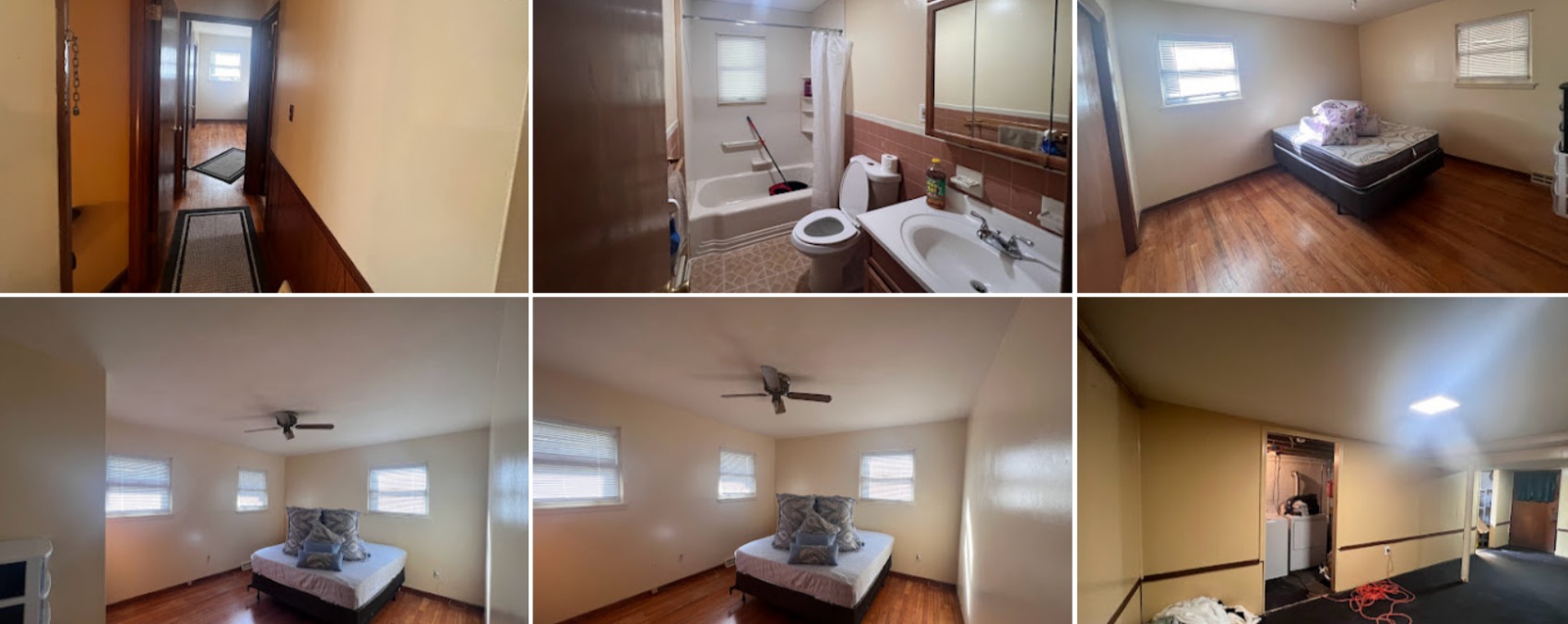

All the properties being auctioned off are foreclosures, and there are numerous types of properties up for grabs. You might find single family homes, multi-family homes, mixed-use properties, larger complexes, and even commercial buildings available for purchase.

Where Does a Sheriff’s Sale Take Place?

Sales typically take place in the sheriff’s office or at the county courthouse. In some areas of the country, they’re actually conducted on the front steps of the courthouse rather than inside.

A sheriff’s sale is open to the public. Lenders sometimes attend or send a representative in an effort to bid to try to buy back their own property. This move by the lender is permitted. One thing to note: everyone must have certified funds available before they can bid on a property. Usually 20% certified check made to sheriff county office + $5000 cash allowed

How to View a List of Properties

You can go to a couple of places to view a list of the properties that will be auctioned off at the next sheriff’s sale. Many sheriff’s offices have websites where you can view the upcoming sales online. You can also get a list of the properties to be auctioned off by physically going to your local sheriff’s office.

Properties available for purchase are also usually advertised in the local newspaper as much as a month before the actual sale date. Your local sheriff’s office can tell you which publications will carry the notice.

Each property will usually include a docket number, a sheriff’s department number, or a court case number. It will name the plaintiff in the foreclosure action and the defendant. It will include the property address and a description of the property, as well as the “upset price.”

What’s an Upset Price?

The upset price is the minimum amount that the plaintiff (typically the lender) will accept for the property. The property won’t be sold if bids don’t meet this amount.

The upset price might be lower or higher than the actual judgment amount, the amount of money the lender is entitled to recover to cover its losses. The plaintiff’s attorney or another representative will often bid on the property to try to drive the price up.

How to Prepare for a Sheriff’s Sale

In order to be prepared for the sale, you may want to do a full coverage title search in advance on all properties you think you might be interested in if you plan to bid. You can also hire an attorney to take care of this for you.

Anil Realtor can help you find good title abstractor . Presently I use someone who charges $250 per search

You’ll want to find out if there are any liens against the property at either the state or federal level. This can include tax liens placed by the Internal Revenue Service or local taxes or even water charges. It can be a judgment lien placed by another of the homeowner’s creditors. You might be responsible for paying any of these liens that were not wiped out during the foreclosure court proceedings.

Contact the town or municipality where the property is located to find out if there are any open permits on the property. You’ll have to spend money to close them out if you purchase it.

When Do You Have to Close on the Property?

Again, this will depend on the rules set for each individual sheriff’s sale, but you must usually close within 30 days of successfully bidding on the property and submitting your down payment.

Many sheriff’s sales will publish these rules online, or you can call or go to the sheriff’s office for a full list of requirements.

Contents of notice posted by Sheriff

[Appendix XI-KI NOTICE TO RESIDENTIAL TENANTS OF RIGHTS DURING FORECLOSURE

A FORECLOSURE ACTION HAS BEEN FILED CONCERNING XXXXXXXXXXXXXXXXXXXXX, AND THE OWNERSHIP THE PROPERTY MAY CHANGE AS A RESULT.

UNTIL OWNERSHIP OF THE PROPERTY CHANGES OR YOU ARE OTHERWISE INFORMED BY THE COURT OR THE MORTGAGE HOLDER, YOU SHOULD CONTINUE TO PAY RENT TO THE LANDLORD OR TO A RENT RECEIVER, IF ONE IS APPOINTED BY THE COURT. YOU SHOULD KEEP RECEIPTS OR CANCELED CHECKS OF YOUR RENT PAYMENTS. IF YOU ARE NOT SURE HOW OR WHERE TO PAY RENT, SAVE YOUR RENT MONEY SO THAT YOU WILL HAVE IT WHEN THE OWNER DEMANDS IT. NONPAYMENT OF RENT IS GROUNDS FOR EVICTION.

FORECLOSURE ALONE IS GENERALLY NOT GROUNDS TO REMOVE A BONA FIDE RESIDENTIAL TENANT. TENANTS WHO WANT TO STAY IN THEIR HOMES CAN BE REMOVED ONLY THROUGH A COURT PROCESS. WITH LIMITED EXCEPTIONS, THE NEW JERSEY “ANTI-EVICTION ACT” PROTECTS RESIDENTIAL TENANTS’ RIGHTS TO REMAIN IN THEIR HOME. THIS LAW INCLUDES PROTECTION FOR TENANTS WHO DO NOT HAVE WRITTEN LEASES.

IT IS UNLAWFUL FOR ANYONE TO TRY TO FORCE YOU TO LEAVE YOUR HOME OUTSIDE THE COURT PROCESS, INCLUDING BY SHUTTING OFF UTILITIES OR FAILING TO MAINTAIN THE PREMISES.

[Note: Appendix XII-K adopted November 17, 2009 to be effective immediately.]